Contributions

When your new pension scheme has been set up and your staff have been assessed it is time to make the pension contributions.

In practice most firms have set up their auto enrolment pension schemes to require a contribution from the staff, but this is not strictly necessary, and the legislation allows for some flexibility here. As long as the total minimum contributions are paid, and the employer is paying their minimum contribution, it does not matter where the rest comes from.

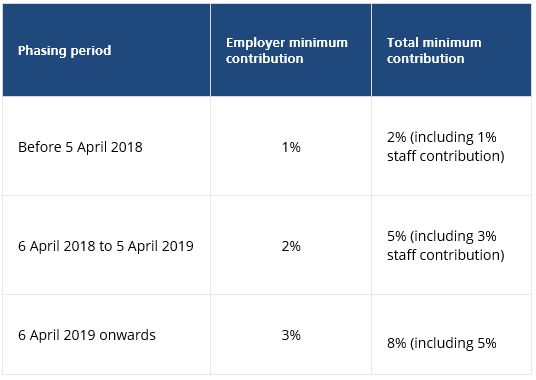

Typically, though, in our experience most firms are making contributions in line with the following table from The Pensions Regulator.

As you can see, although the minimum auto enrolment contributions begin at only 2% total (typically paid as 1% each from the employer and employee), these will increase over the next two years until they reach a combined figure of 8%.

Although your employer minimum contributions will triple, increasing to 3% in 2019, it is your employees who will face the sharpest increase as their contributions could rise from 1% to 8% of their salary.

How you want to handle this as the employer is up to you. You only need to make sure you are making the minimum contributions due. See our page on your options as an employer for more information.